Bank lending to small businesses up 82% in 2020 as founders tackle COVID-19

Posted: Wed 10th Mar 2021

Gross bank funding provided to small businesses jumped by 82% in 2020, driven by a huge demand for loans through the government's coronavirus lending schemes.

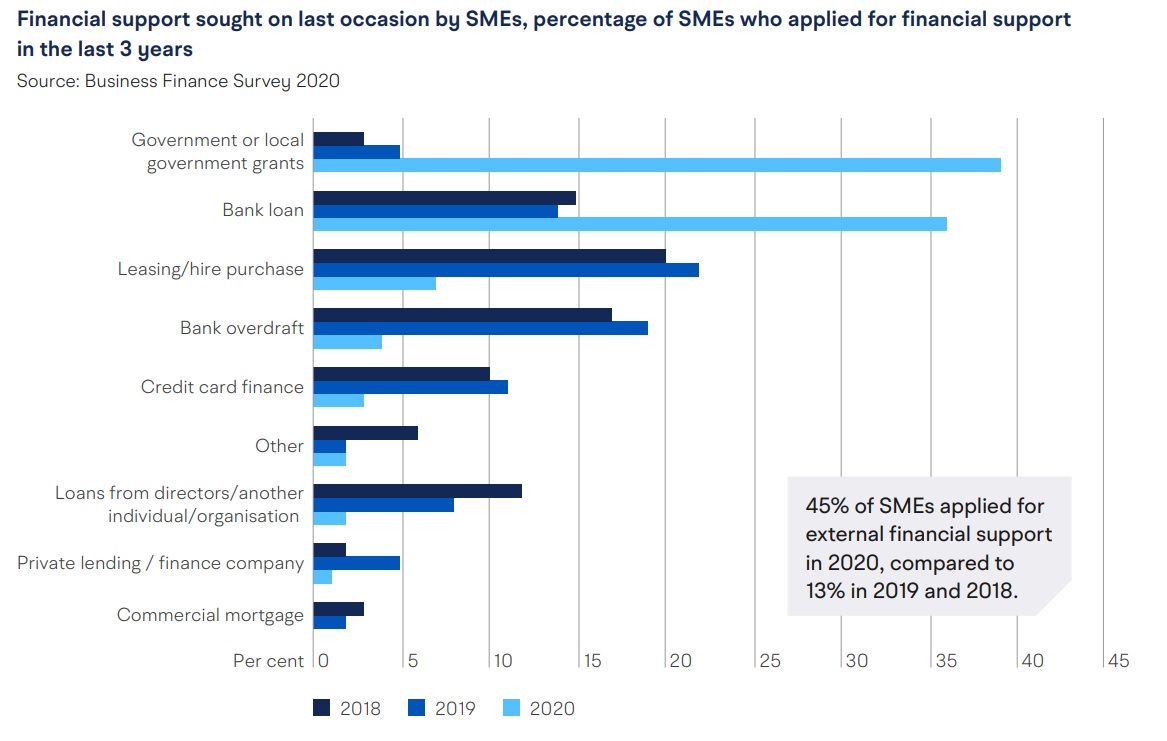

Almost half of the UK's businesses applied for external finance in 2020, compared to just 13% in 2019, the report by the British Business Bank said.

Total lending to SMEs reached £104bn last year, 70% of which came through the pandemic-specific schemes.

Why did small businesses seek funding?

With the Bounce Back Loan Scheme alone topping £46bn so far, 89% of firms sought finance due to coronavirus. Although the vast majority, 75%, did so to help with cashflow, 8% wanted funding to pivot their business model and 7% were funding investments in digital capabilities.

Demand for traditional bank loans fell significantly as businesses turned to government guaranteed loans. Usage of bank overdrafts, credit cards and asset finance all fell.

In contrast, use of grants rose from 2% in 2019 to 31% in 2020 due to the government's various COVID-19 business grant schemes.

The government's Start Up Loans programme lent £126m in 2020, the highest annual figure since it launched in 2012.

Most sectors have seen between 20% and 30% of businesses taking out a loan during the pandemic as turnovers took a big hit.

The smallest companies experienced the biggest declines with 49% firms with no staff reporting a fall in turnover over the past 12 months compared to 38% of those with 50-249 employees.

How will small businesses recover?

As plans are put in place for the reopening of the economy, the report found that 37% of smaller business expect to stay the same size over the next 12 months, 33% believe they will shrink, and 4% plan to sell or close. One in five (21%) predict growth, compared to 28% in 2019.

Total outstanding debts for SMEs increased from £168bn in 2019 to £213bn in 2020 and business owners' worries about their ability to repay loans also rose. Hospitality was the highest at 37%.

The British Business Bank warned that "a sizeable number" of companies are "likely to struggle with debt repayments", but there could be "significant further demand" for funding in 2021 as businesses continue to deal with effects of the pandemic.

The government's current coronavirus loan schemes close in April and will be replaced by the new Recovery Loan Scheme which chancellor Rishi Sunak announced in the Budget earlier this month.

Enterprise Nation founder Emma Jones said: "With UK SMEs now in debt to the tune of £213bn, it is clear there needs to be an accessible and affordable solution to helping business owners manage and repay that liability.

"For the majority, it will be the first time they have ever taken a loan or secured finance against future trade. The banks have done their job in shoring up the economy and moving forward small businesses need careful help with longer term challenges including seeking future forms of finance to not only service debt, but to take the opportunity to grow post-pandemic.

"If we are going to realise growth, borrowers must be supported to ready for the re-opening of the economy and access advice and support to help them boost sales in the UK and abroad.

"It concerns us that this debt figure is released on the same day an MP led inquiry concluded the UK is suffering from a shortage of skilled salespeople. We need the sales to pay back the loans and it is support for small businesses to trade and generate revenue on which Enterprise Nation is focused."

Advice on reopening a physical business

As part of Enterprise Nation's Hello, World campaign in partnership with SumUp, you are invited to join a free event on 25 March designed to help small businesses re-engage with customers in a physical format.

Register today to hear from successful entrepreneurs, retail specialists and industry leaders who will help you prepare your business for the future of physical retail.

Get business support right to your inbox

Subscribe to our newsletter to receive business tips, learn about new funding programmes, join upcoming events, take e-learning courses, and more.

Start your business journey today

Take the first step to successfully starting and growing your business.

Join for free