Regional distribution of Coronavirus Business Interruption Loan and Bounce Back Loan schemes revealed

Posted: Fri 7th Aug 2020

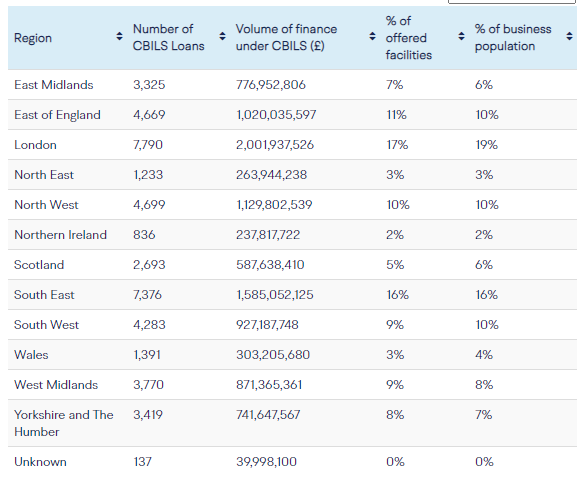

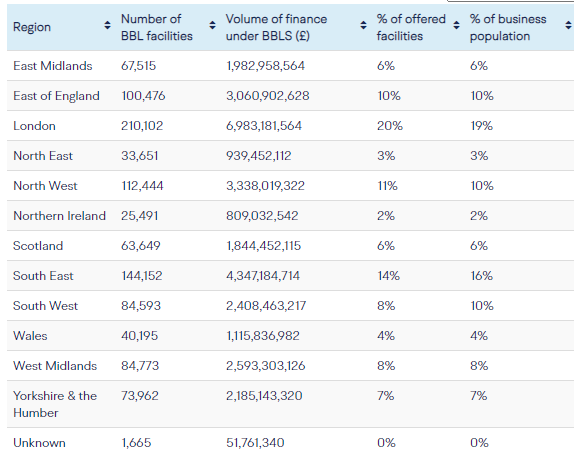

Businesses in London and the South East have received the highest proportion of loans from the Coronavirus Business Interruption Loan Scheme (CBILS) and Bounce Back Loan Scheme (BBLS).

New figures released by the British Business Bank show that 33% of CBILS loans and 34% of BBLS loans worth more than £3.5bn have been approved for firms in those areas.

At 11%, companies in the East of England have secured the received the highest proportion of CBILS loans outside of London and the South East, and for BBLS it's the North West with the same proportion.

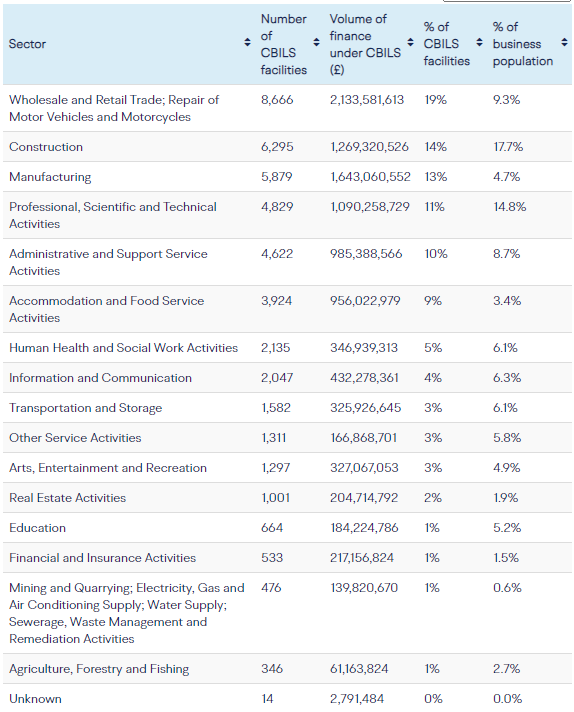

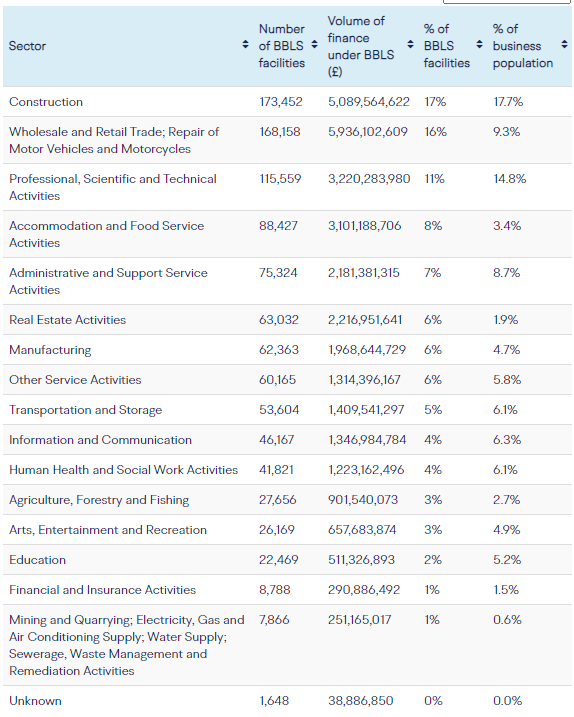

Despite being 9% of the UK's total business population, 19% of CBILS loans have gone to wholesale and retail companies. For BBLS, construction firms have received the most loans at 17% of the total.

Latest government figures show that as of 2 August, 58,595 CBILS loans from 119,248 applications worth £13.08bn have been approved.

For BBLS, the figures are 1,135,575 approved loans from 1,377,955 applications worth £34.44bn.

The regional and sector figures are below and a full breakdown by consistuency is here.

Breakdown of loans offered by region - CBILS

Breakdown of facilities offered by region - BBLS

Breakdown of facilities offered by sector - CBILS

Breakdown of facilities offered by sector - BBLS

Get business support right to your inbox

Subscribe to our newsletter to receive business tips, learn about new funding programmes, join upcoming events, take e-learning courses, and more.

Start your business journey today

Take the first step to successfully starting and growing your business.

Join for free