Eight key metrics for running a successful equity crowdfunding campaign

Posted: Tue 2nd Oct 2018

Equity crowdfunding is a great way to get the funds you need to execute an ambitious business plan.

In this blog, Adrià Tarrida, crowdfunding consultant at Crowdeasy, discusses the key metrics you'll need to consider and offers tips on how to maximise your chances of success.

Introducing equity crowdfunding

If you're looking at ways to finance your business, you might have come across equity crowdfunding. It's a great way to obtain the funds you need in exchange for shares in your business.

Not only will get the money, but on the way, you'll raise awareness of your business, gain a host of really engaged ambassadors (your investors!) whilst validating your business model. What's not to like!

Well, let's be clear, it's also really hard work and success rates are not very high. To try to demystify the industry, let's take a look at some metrics that might help you decide if equity crowdfunding is right for your company.

Your own metrics:

Money you'd like to raise: How much money do you need to carry out your business plan? Be single minded, clear, be ruthless. Investors will want to understand exactly how you're going to spend their money. Make sure you're aiming for enough money to carry out your plan but not more, so you don't have to give too much equity (see next point). Also, it's important to build in all of the costs of the campaign. Do consider, amongst other, the fees for your video agency, accountants, legal, and the platform fees (between 6 and 7%).

Equity released: The equity you're releasing, in combination with the money you want to raise, will determine your company valuation. And valuing a start-up is always tricky. The founders will try to get away with handing out the minimum equity possible, whilst investors will want to see that their money gets them a fair share of the company. There are several ways to value a company, please do get in touch to find out more.

Platform/project metrics

Average money raised In 2017 crowdfunding platform Crowdcube reported an average raise of £692,000 whilst its main competitor, Seedrs reported just over £744,000. This average has been raising consistently in the last few years, signalling that the industry is maturing, with more investors in the platforms and more sophisticated investors considering it a way to diversify their portfolios.

Average investment: In 2017 investors on Seedrs put just over £2,000 in the projects they decide to back, whilst on Crowdcube the number was £1,428. From this metric and the previous one, we can deduct the average number of investors per campaign: 333 for Crowdcube and 278 for Seedrs.

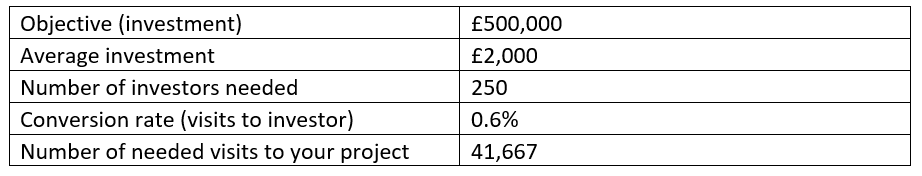

Conversion rate (unique visits to your pitch to investment): The platforms are reluctant to release data on this front, but our experience with Crowdeasy is that, on average, only 0.6% of the unique visitors to your pitch end up investing. So you'll need a lot of eyeballs on your project to get to your objective. Let's illustrate it with an example (with rounded up figures for clarity):

Let's go back to your own metrics to see how you'll increase your chances to be successful:

Size of your email list: From the moment you decide to crowdfund, it's crucial that you map out your crowd. Think as broadly as you can, starting with the proverbial 3 Fs (friends, fools and family) and extending this to weaker connections. LinkedIn is a great tool for that. Capture emails and engage your best prospects from the beginning of the pre-campaign. If they're aware and feel that they've had a say on your business plan, they'll feel much more compelled to invest. Which brings me to the next point...

Investment secured before launch: The platforms will launch your project in private mode and, until you've raised about 30% it will remain so. This is to avoid the 'empty restaurant' feeling: when you're looking for somewhere to eat, you tend to choose the places that have a certain crowd. Equally, investors that are not aware of your project will look for the validation of other investors committing their money. So, at least, you should have 30% of your money secured before launching, ideally more. That's when the size of your email list plays a key role.

Finally, our last metric. How likely are you to raise the money you need?

Success rate: This is a very contentious metric, as there are several ways to measure it. First of all, there is a very tough filter to get your project up in one of the platforms. After all, a low success rate is in nobody's interest. Seedrs claims to only launch 1 out of every 10 companies that engage with them. Then they also claim a 74% success rate vs. 51% from their nearest competitor, but obviously Crowdcube challenges that. In any case, what both platforms agree on is that projects that receive the support from a specialised agency or accelerator have a much higher chance to be successful. In fact, they are actively encouraging companies to engage with specialists.

So, in summary, running an equity crowdfunding campaign is not easy, due to the high complexity of running a campaign. You'll need to get a lot of eyeballs on your pitch, and that requires a lot of marketing and communication skills, combined with financial, legal and project management acumen.

Looking for finance for your business?

Personalised finance options for start-ups, small businesses, sole traders and freelancers. Take the Funding Hub tool and get recommendations tailored to your financial needs.

Relevant resources