How to register as a sole trader

)

Posted: Tue 29th Jul 2025

So, you've decided to start your own London-based business? Congratulations! It's an exciting step to take and you're in one of the best cities in the world for innovation and entrepreneurship.

But before you can sell anything, for legal and tax purposes, you need to choose a structure for your business.

Becoming a sole trader is the most straightforward option. It's especially suited to those just starting out, as set-up is simple, there's little ongoing admin to contend with and you get to keep all your profits after tax.

Just be aware that, unlike other legal structures, you remain personally responsible for the debts of your business.

You can start trading straight away as a sole trader – perfect for those looking to quickly capitalise on an opportunity in a fast-moving city like London – but you must register for Self Assessment as soon as you start to earn more than £1,000 in a tax year.

Here's everything you need to know about how to register, who needs to do it and the responsibilities you have as a sole trader.

What is a sole trader?

A sole trader is one of the four types of business structures in the UK. You can register as a sole trader if you're a self-employed individual who is responsible for making all your own business decisions.

As a sole trader, you must choose a name for your business and keep accurate financial records for your Self Assessment tax return.

You'll have to pay income tax, National Insurance and, if you earn more than £90,000 in a year, VAT, but you get to keep all your own profits.

Remember that, as there is no legal distinction between you and your business, you have "unlimited liability" for its debts and obligations.

Being a sole trader does not prohibit you from being employed – you can run your business alongside an existing job, which is great if it's a side hustle or you want some financial stability while you test the viability of your new idea.

You can also hire employees as a sole trader, as long as you register as an employer with HMRC and remain the sole owner of your business.

Pros and cons of being a sole trader

Pros

Simple set-up and straightforward structure. For example, unlike setting up a limited company, you don't need to open a separate business bank account for your earnings or pay a registration fee.

There's little ongoing paperwork or administration.

You keep all your profits after tax.

You make all your own business decisions.

There's no need to pay corporation tax or file annual accounts to Companies House.

Cons

As you have unlimited liability for your business, you're solely responsible for any debts and legal issues. That means assets such as your house could be at risk if your business gets into financial difficulty.

It's less tax-efficient. For example, as the director of a limited company, you can pay yourself dividends, which are charged at a lower rate than income tax. As a sole trader, all profits are taxed as personal income.

You cannot have a business partner, meaning there's no one to share the responsibilities, workload and decision-making.

Who needs to register?

Essentially, registering as a sole trader is registering for Self Assessment with HM Revenue & Customs (HMRC).

You must register as soon as you earn more than £1,000 in a tax year (6 April to 5 April the following year).

The deadline to do so is 5 October after the conclusion of the tax year in which you exceed the threshold. If you register late, you may have to pay a penalty.

It doesn't matter what goods or services you're selling, whether you're running your business full time or in your spare time, from home or a dedicated office. If you're earning money from self-employment, it's classed as taxable income and you must register.

For example, you must register for Self Assessment if you:

Sell homemade items from a stall at a London market or on a website like Etsy.

Provide freelance graphic design services online.

Carry out paid plumbing work for friends and neighbours in your borough.

Provide consultancy services to startups.

Registering as a sole trader is also essential if you need to prove you're self-employed in order to claim certain benefits, like tax-free childcare, or to help you qualify for benefits and the State Pension by voluntarily paying Class 2 National Insurance.

How to register with HMRC

If business is going well, it won't be long before you hit that £1,000 ceiling and need to register.

So how do you do it? First, make sure you have your National Insurance (NI) number to hand, as well as your personal and business details.

If you don't yet have your NI number, you can apply as long as you live and have the right to work in the UK.

Step one: check how to register

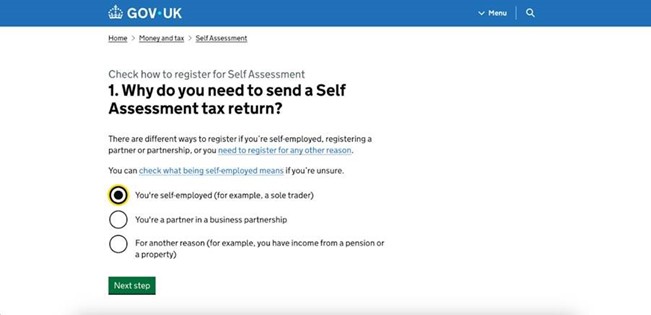

Visit GOV.UK's register for Self Assessment page, click the "Start now" button and follow the prompts. You'll then have to answer a few questions.

Firstly, why do you need to send a Self Assessment tax return? Click that you're self-employed.

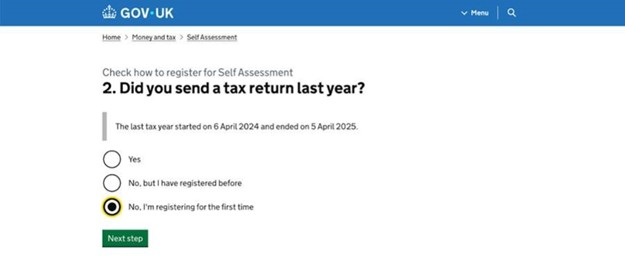

Secondly, did you send a tax return last year? If you did, you need to reactivate your account. But assuming you didn't, answer that you're registering for the first time.

You'll then be presented with a page that tells you how you can register.

You can do so by post (the form you need to fill in and address to send it to are provided), but let's assume you'll register online as this is the quickest and easiest way.

Follow the link to sign into your business tax account, even if you don't yet have one.

Step two: sign in or create a business tax account

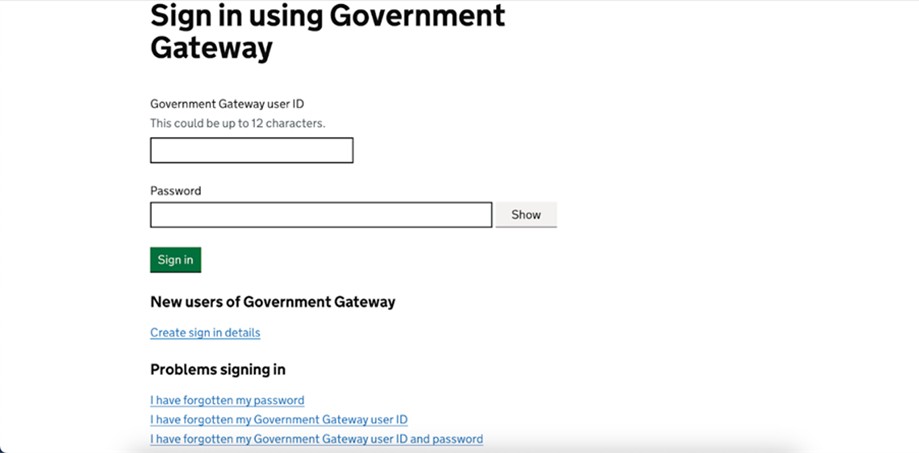

You can sign into your business tax account using GOV.UK's Government Gateway. If you're a new user, you just need to enter and confirm your email address to create sign-in details. You'll then get a Government Gateway ID.

Step three: add Self Assessment to your account

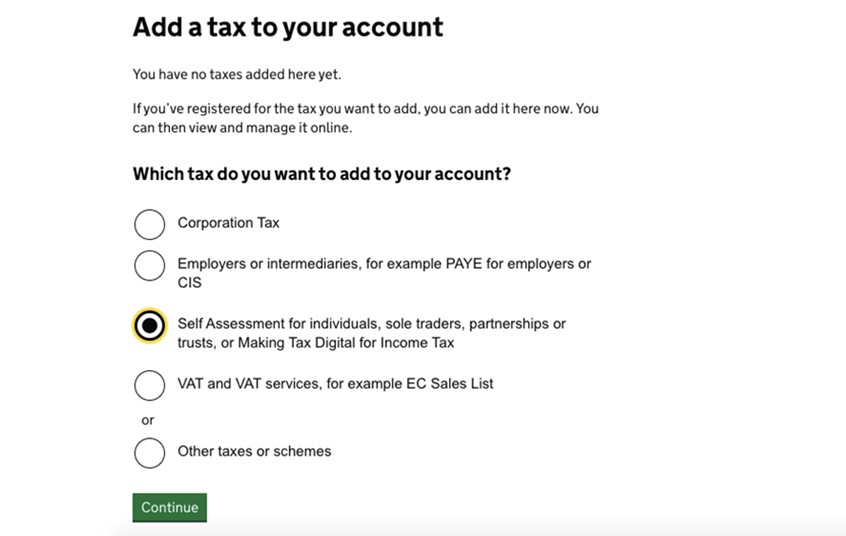

Once you've logged in to your business tax account, select "Add a tax to your account to get online access to a tax, duty or scheme".

Choose "Self Assessment for individuals, sole traders, partnerships or trusts, or Making Tax Digital for Income Tax".

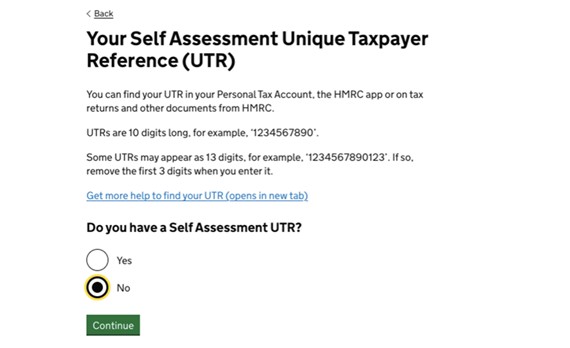

And click that you don't yet have a Unique Taxpayer Reference (UTR) and, on the next page, that you're an individual or sole trader.

Step four: complete the Self Assessment form

You'll need to provide the following information:

National Insurance number.

Your full name (and any previous names), date of birth and gender.

Your current address and the date you moved in.

Your phone number and email address.

Whether you've registered previously for Self Assessment.

The name and nature of your business.

Your business address (if different from your home address).

The date you became self-employed.

What next?

Once you've completed the form, you've successfully registered for Self Assessment as a sole trader.

You should receive your UTR by post within 15 working days of registering, or 21 days if you're abroad. You'll be able to see it sooner if you use the HMRC app.

What happens after you register?

Now you have your UTR, you'll need to keep accurate financial records and prepare to pay for your Self Assessment tax return by 31 January every year.

You can file your tax return at any time on or after 6 April, the end of the tax year, as long as you do so by the deadlines for paper (31 October) and online (31 January) tax returns.

As a sole trader, you'll pay:

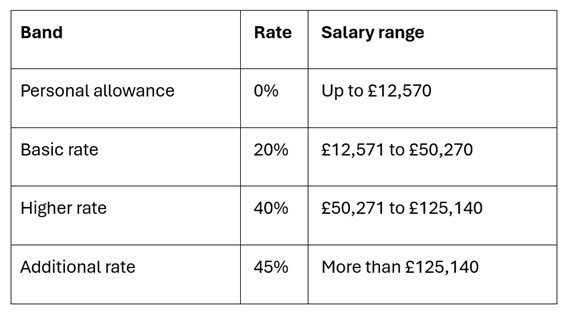

Income tax

You pay income tax on all earnings after your expenses have been deducted.

National Insurance (Class 2 and Class 4)

National Insurance (NI) is a tax on earnings and self-employed profits which pays for things like the State Pension, the NHS and other benefits.

As a self-employed person, you can voluntarily pay Class 2 NI contributions (£3.45 a week) if you do not earn more than £6,725 a year in profit in order to protect your NI record, which helps give you access to benefits.

Once you exceed the personal allowance of £12,570 a year, you'll pay Class 4 contributions.

For the tax year 2024 to 2025, the rates are:

6% on profits of £12,570 up to £50,270

2% on profits more than £50,270

VAT

If your annual turnover exceeds £90,000 – within any rolling 12-month period, not just the financial year – you must register for value added tax (VAT).

This means you now have to charge the standard rate of 20% on any goods and services you sell. You must also issue VAT invoices to your customers.

Every quarter, you submit a VAT return to HMRC detailing all the VAT you've paid or charged. You will then either pay the difference, if you've charged more than you've paid, or receive a refund, if you've paid more than you've charged.

Tips for London-based sole traders

London is one of the best cities in the world to be a sole trader – here are some top tips:

Make the most of Grow London Local support

Grow London Local offers a variety of online support and resources, as well as free events to help businesses like yours succeed.

You can book in with one of our Business Support Managers or sign up for a free Business Success Check to get personalised recommendations for your business in less than five minutes.

Plus, check out these exclusive promotions and money-saving tools that can make running your business that little bit easier.

Build your brand

As a sole trader, the responsibility to build your brand rests with you alone. In a crowded and competitive city like London, it's not enough to have a brilliant product or service, you need to shout about it.

You can build a website quickly and easily using a website builder. You should also create a social media presence on the key platforms that your target market uses (for example, if that's a younger demographic, focus on TikTok).

Meet fellow entrepreneurs

There are many coworking spaces in the capital. If you can afford the expense, working from a coworking space rather than at home is a great way for sole traders to feel part of a community, meet like-minded people and learn from your peers.

Or you could make useful connections, discover new opportunities and get inspired by other entrepreneurs at networking events like our Coffee Fridays.

Fund your sole trader business growth

Check whether there are any grants available in your borough that your business is eligible for or seek funding from London-based venture capital or angel investors.

Do I need a business bank account as a sole trader?

You don't have to open a business bank account as a sole trader, but it can be helpful to keep your personal and business finances separate for expenses purposes.

Protecting IP

If you're concerned about intellectual property (IP) theft, there are several ways to protect your business via the Intellectual Property Office (IPO), including:

Trademarking your product names and logos.

Registering the design, including its shape, packaging and patterns.

Patenting something you've invented (it must be completely new, not a change to something that already exists and must not have been described in a publication). Be aware that this can take several years and currently costs at least £310.

Dealing with late-paying clients

If a client is late to pay an invoice (and you've already nudged them to settle and checked the invoice you sent had all the correct details), you can seek legal advice or attempt to resolve the issue via the Small Business Commissioner (SBC), which can make non-binding recommendations for resolving disputes.

Understanding HMRC

Once you've registered with HMRC, it will send you reminders to complete your Self Assessment and pay your taxes.

It can fine you if you're late or misrepresent your tax liability.

If you're struggling or unsure about your taxes, HMRC provides helpful resources and telephone support. You can also request a payment plan, with interest, if you're unable to pay your taxes in full on time.

Being a sole trader doesn't have to mean always flying solo. At Grow London Local, we help you succeed through a combination of networking, community events and free help from our Business Support Managers.

Read more

Grow London Local: Support for London's small businesses

No matter where you're based in London, you'll find relevant support and guidance on business planning, sales and marketing and much more, as well as opportunities to connect with like-minded business owners. Visit Grow London Local now

Get business support right to your inbox

Subscribe to our newsletter to receive business tips, learn about new funding programmes, join upcoming events, take e-learning courses, and more.

Start your business journey today

Take the first step to successfully starting and growing your business.

Join for free