Coronavirus loans lent to businesses reach £1.1bn

.png)

Posted: Wed 15th Apr 2020

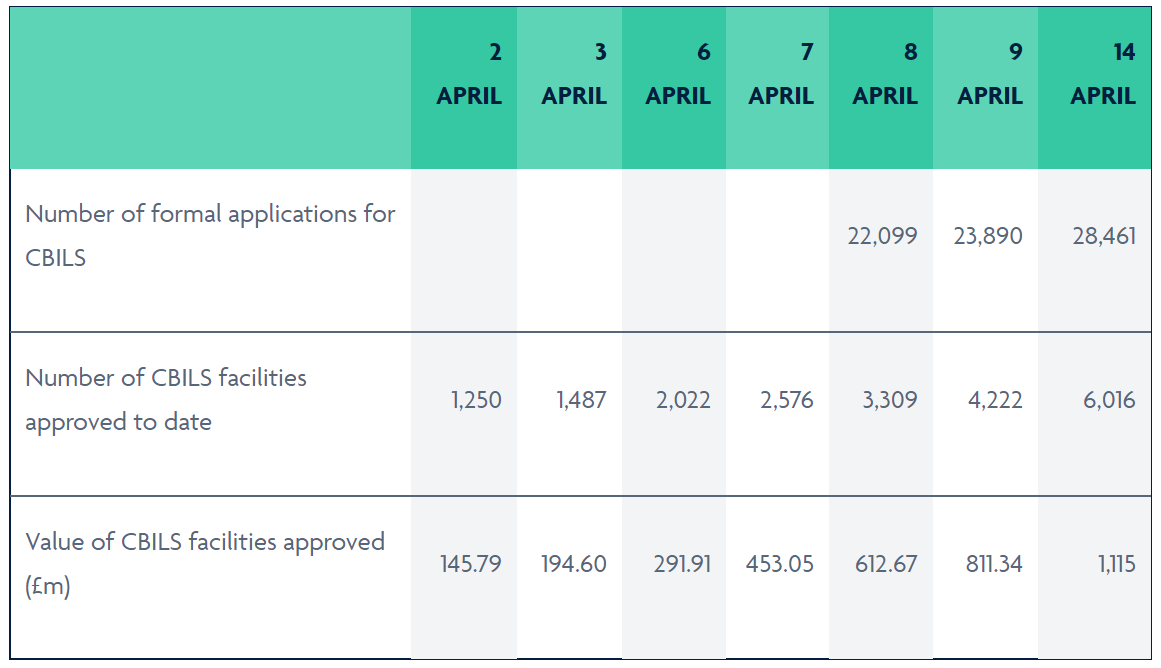

Banks and other lenders have provided £1.1bn in loans to small businesses through the Coronavirus Business Interruption Loan Scheme (CBILS).

UK Finance, the trade body for the UK's banking and finance industry, released the figures and said total lending under the scheme has grown by 150% to £700m in the last week.

A total of 6,020 loans have been provided so far with the number of daily loans rising from 240 on 2 April to 910 on 8 April.

It has been reported that there have been over 300,000 enquiries for funding but UK Finance said there has been 28,461 formal applications. That figure includes approved applications, those still being processed, declined applications and applications that may turn out not to be eligible or where businesses decide not to proceed.

The latest figures follow criticism that entrepreneurs are struggling to access funding with long waits for a decision on applications.

Several business owners have also told Enterprise Nation that lenders are only accepting loans from existing customers and not providing funding below £25,000.

UK Finance admitted there is a time lag before applications are approved and during a webinar on Wednesday organised by Festival of Enterprise, Simon Dawson from NatWest said he has spoken to business owners this week who first applied in late March.

He also confirmed that NatWest is providing loans from £5,000 and will take applications from non-customers if their own bank is not part of CBILS.

The scheme was launched on 23 March with more than 40 accredited lenders. New banks have since been approved including Starling Bank and The Co-operative Bank.

Businesses turning over less than £45m can access loans and overdrafts of up to £5m that are fee and interest-free for 12 months. The government supplies an 80% guarantee to encourage lenders to provide funding but borrowers remain 100% liable for the loans.

To help speed up loan approvals, there have been calls, including by Labour's shadow business secretary Ed Miliband, for the government to increase its guarantee to 100%. In Germany, a similar scheme provides a full guarantee.

Speaking during the government's coronavirus daily update on Tuesday, chancellor Rishi Sunak said he was open to discussing the idea.

UK Finance said beginning on 23 April, it will release new CBILS data every Thursday.

Read a guide on applying for the Coronavirus Business Interruption Loan Scheme here.

The latest coronavirus support information

We are keeping you updated on the latest information on how to access the government's coronavirus business support here. You can also find advice and ask a question on Enterprise Nation's coronavirus business advice hub. Follow Enterprise Nation on Twitter too for updates.

Get business support right to your inbox

Subscribe to our newsletter to receive business tips, learn about new funding programmes, join upcoming events, take e-learning courses, and more.

Start your business journey today

Take the first step to successfully starting and growing your business.

Join for free